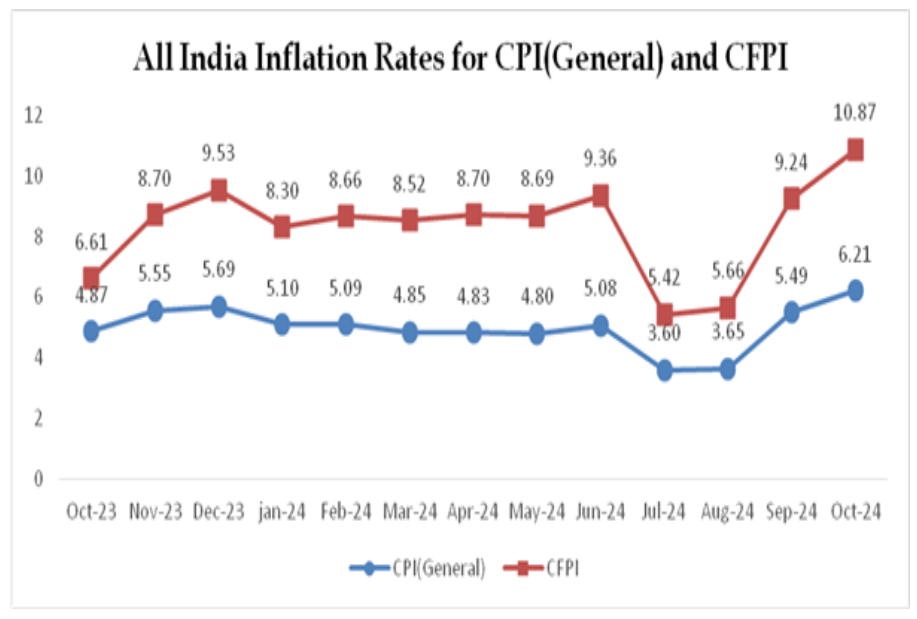

India’s retail inflation rose to 6.21% in September, up from 5.49% in September, according to data from the Ministry of Statistics and Programme Implementation (MoSPI) released on Tuesday.

In October, retail inflation breached the Reserve Bank of India’s target range of 2-6%, signaling continued price pressures.

“This inflationary uptick to rising prices of perishable vegetables, edible oils, and wheat. Additionally, increased gold prices have contributed to inflation in the personal care category of the Consumer Price Index (CPI),” stated Madhavi Arora, Chief Economist at Emkay Global Financial Services.

The data highlighted a divide between rural and urban inflation rates, with rural inflation reaching 6.68% compared to 5.62% in urban areas.

Food prices played a significant role in driving inflation, surging to 10.87% in October from 9.24% in September.

Food inflation rates in rural and urban areas were recorded at 10.69% and 11.09%, respectively. This escalation in food prices was mainly driven by cereals, vegetables, and pulses, which saw substantial increases following weather-related disruptions.

Housing inflation, which is measured solely for the housing sector, experienced a modest rise, reaching 2.81% in October from 2.72% in September.“CPI inflation in November is likely to ease to around 5.4% due to falling vegetable prices, inflation for the third quarter of FY25 is tracking higher at 5.5-5.6%, compared to the RBI’s forecast of 4.8%. For FY25 overall, inflation is now expected to reach approximately 4.85%, exceeding the RBI’s forecast of 4.5%,” said Madhavi Arora, Chief Economist, Emkay Global Financial Services.

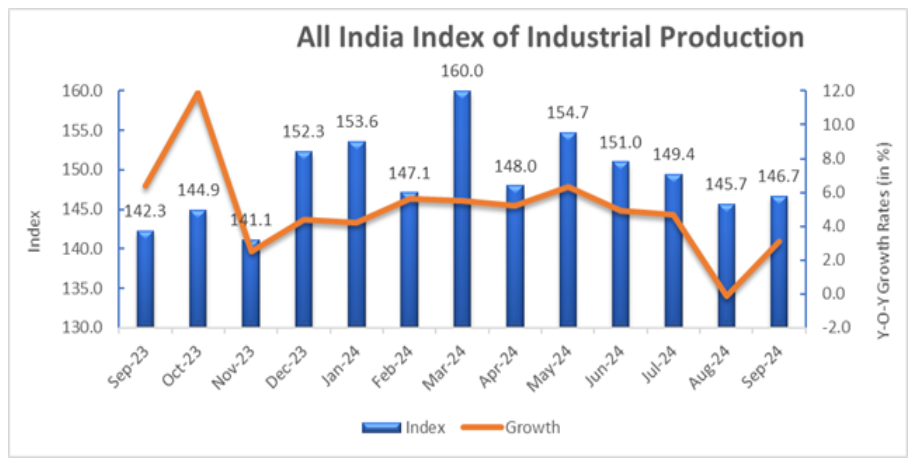

The Index of Industrial Production (IIP) showed improvement, registering a growth rate of 3.1% in September, compared to a contraction of 0.1% in August, as per MoSPI data.

Among the key sectors, manufacturing grew by 3.9%, mining by 0.2%, and electricity by 0.5% in September.

The overall IIP index was reported at 146.7 in September, up from 142.3 a year earlier, with sector-specific indices for mining, manufacturing, and electricity standing at 111.7, 147.0, and 206.9, respectively.