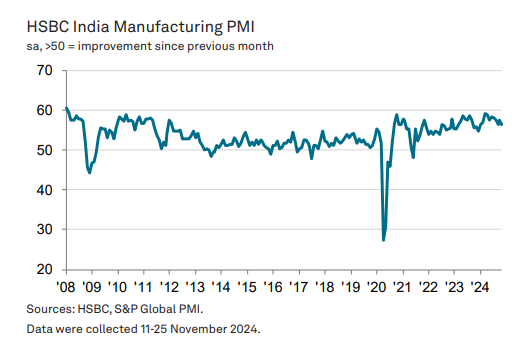

India’s manufacturing sector witnessed a slowdown in November, with the seasonally adjusted Manufacturing Purchasing Managers’ Index (PMI) falling to 56.5 from October’s 57.5, the data released by S&P Global showed on Monday.

This marks a return to September’s eight-month low, signalling a deceleration in the rate of expansion, though it remains historically strong and firmly in growth territory.

The moderation in growth was attributed to heightened competition, inflationary pressures, and subdued orders at certain units.

Despite the challenges, the sector continued to add jobs for the ninth consecutive month. The pace of employment growth softened compared to October but remained robust, with businesses hiring on both permanent and temporary contracts.

November’s PMI marked the slowest expansion in 2024 to date, although the rate of accumulation was still above the long-run average. Additionally, the streak of declining finished goods stocks, which began in August 2017, came to an end.

Optimism about the sector’s future remains strong, bolstered by expectations of increased demand, successful marketing initiatives, and new product launches. Manufacturers are also encouraged by recent capacity expansions and forecasts for sustained demand, fueling positive output projections for 2025.

Input costs for materials, labour, and transportation surged in November, pushing output prices to their highest in over a decade. Rising costs of intermediate goods such as chemicals, cotton, leather, and rubber added to the strain, with many manufacturers passing these expenses onto consumers.

Pranjul Bhandari, Chief India Economist at HSBC, stated, “India’s manufacturing PMI stood at 56.5 in November, slightly below the previous month but well within expansionary territory. Broad-based international demand, evidenced by a four-month high in new export orders, supported continued growth in the sector.”

She further highlighted that input costs rose sharply, and output prices hit an eleven-year high, reflecting the rising costs of production,” she added.

Movement of Manufacturing PMI in FY25

The Manufacturing PMI is a key economic indicator that tracks the health of the manufacturing sector. It provides insights into various aspects of manufacturing activity, including production levels, new orders, employment, supplier delivery times, and input costs.

Manufacturing PMI below 50 indicates contraction in manufacturing activity, the number above 50 signals expansion in manufacturing activity, and a PMI at 50 suggests stagnation, with no significant change in manufacturing activity.