[ad_1]

NEW DELHI: The festive season has brought some cheer to the economy with several data releases on Friday suggesting improved consumer sentiment, but economists cautioned that growth faces headwinds on various fronts.

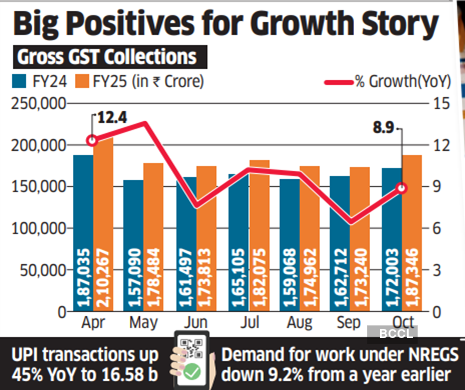

Goods and services tax (GST) collections recovered from record lows in September to post a healthy 8.9% rise in October from a year earlier to Rs 1.87 lakh crore.

Several auto companies such as Maruti Suzuki, Tata Motors, Mahindra & Mahindra and JSW MG Motor India reported record sales last month.

The Unified Payments Interface (UPI) settled 16.58 billion transactions in October 2024, up 45% yearon-year. The demand for work under the government’s flagship rural employment scheme fell for the 12th straight month in October from a year before, dropping 9.2% from a year earlier, indicating availability of job opportunities elsewhere in the economy.

“Contrary to FMCG companies’ message of weak urban spending, consumption is on the right path indicated through GST collections which is a consumptionbased number,” said Bank of Baroda chief economist Madan Sabnavis. “Collections increasing is a positive signal, suggesting that India’s economy will grow about 7%, assuming consumption and private investment will revive.”

Finmin’s Report

Data released Wednesday showed India’s core sector output rose 2% in September from a 42-month low—1.6% decline in August.

Petrol and jet fuel sales jumped around 8% in October on increased travel during the festive season, while sales of diesel—mainly used by commercial long-haul transport—stagnated, official data showed.

“We are hopeful that the abundant monsoon will translate into healthy kharif cash flows, boosting rural demand during the festive season,” said ICRA chief economist Aditi Nayar.

The improved data comes amid concerns that India’s economy may have slowed. In its monthly economic report of September released last week, the finance ministry said there has been “some softening in manufacturing momentum,” while heavy monsoon rain impacted mining and construction activity.

An ETIG analysis of the September quarter results of 175 companies showed revenue and net profit rose by 7.2% and 2.5%, respectively. Revenue growth was the slowest in five quarters while the profit advance was at a six-quarter low.

OUTLOOK

The recovery in government expenditure and better agriculture prospects due to the good June-September monsoon are also expected to support the economy going ahead.

Data released on Wednesday showed the Centre’s fiscal deficit in the first half of FY25 at 29.4% of the annual target, compared with 39.3% a year before.

“In the second half of the year, rural demand is anticipated to improve, driven by better agricultural output, and government expenditure is also expected to rise,” said IDFC First Bank chief economist Gaura Sen Gupta. On the downside, the economy faces risks from still elevated food inflation, escalating geopolitical conflicts and loss of sentiment from the sharp correction in equity markets.

Kotak Mahindra Bank chief economist Upasna Bhardwaj cautioned that growth in the second half of the fiscal year is likely to be slower than that in the first half.

“Activity in the manufacturing sector is showing some signs of fatigue and automobile sales are also slowing,” Bhardwaj said. Still, “while there is an overall slowdown, it is not aworrying trend.”

[ad_2]

Source link