Greetings for the festive season. I am sure you must be excited to celebrate Diwali with your loved ones. Some of you must be looking at air tickets or train berth confirmations and many of you must have planned your weekend just for shopping and decorations. Like many offices in the country, my office is also being decorated and I see colleagues in traditional attire. Well, Diwali certainly cherishes us and sweetens our life…

This Diwali is also special as it has brought additional cheer to many people. Especially the women in Maharashtra, Madhya Pradesh and a few more states where the government has announced various schemes for them. The Maharashtra government has launched a scheme called Maazhi Laadki Bahin Yojana, under which it is offering women from the lower rung of the economic pyramid Rs 1,500 every month. The Madhya Pradesh government, which launched a similar scheme earlier, has now increased the sum from Rs 1,200 to Rs 1,500. This Diwali would be a double celebration for such families as many have got the instalments of 2-3 months in one go. Over 1.12 crore women have applied in Maharashtra for this scheme. Out of which 1 crore 6 lakh have already been approved for the scheme. Most have either received the payment or it is in the process.

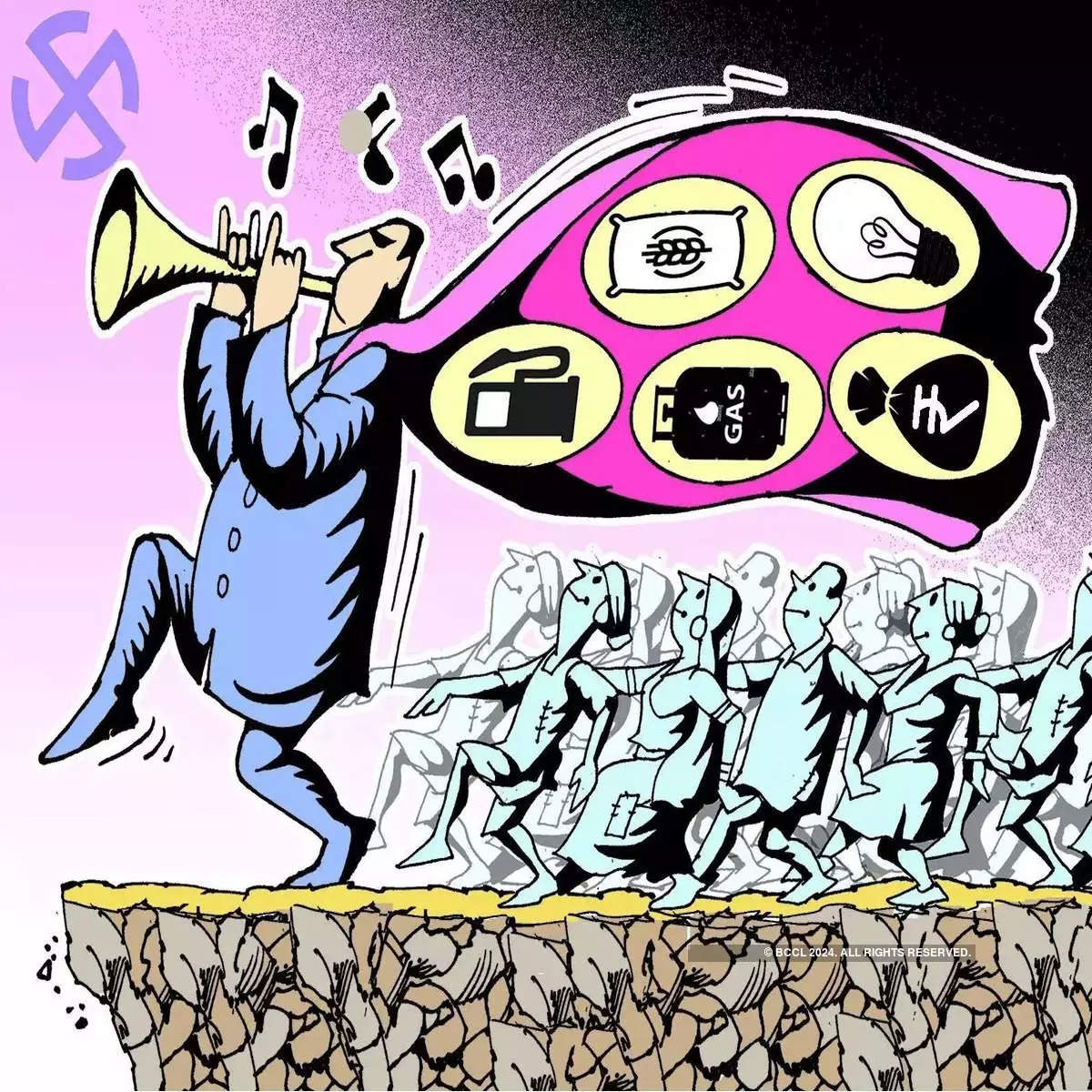

On one hand, I feel happy for the women and households who really need it. But on the other hand, the question that comes to my mind is whether it is a good idea. Freebies and ‘revadi’ culture are not new for India, but in the last few years this phenomenon has grown significantly. On one hand, when we are talking about building a country and doubling the GDP we should have better ideas to deal with finances. The Maharashtra government will spend more than Rs 45,000 crore on this particular project. Of course, the scheme has been launched keeping the upcoming elections in mind. But the larger impact on the state economy and India as a whole will be huge because other states will also follow the footsteps.

Freebies impact

Such freebie schemes will have a multi-fold impact on the economy. The challenge is the government has been offering so many schemes such as free ration, MGNREGA employment, farmer subsidy and now the payment to women. With such schemes, decent money is coming to rural households, which some claim encourages them not to work and makes them lazy. I spoke to a sarpanch (pradhan) of a small village, he said there are easily two women in one household who get Rs 3,000 without any reason now. The man in the household is also benefiting from some other schemes and there is free ration, so there are fewer expenses. Some claim that the government has launched so many schemes that people don’t want to work anymore in the smaller towns. Labour shortage is a real problem because there are people who get free ration and they are choosing not to work. There is an urgent need to shift workers from the agriculture sector to manufacturing and other sectors for all-round economic growth, which is hampered by such freebies.

Such schemes are also allegedly fuelling corruption. There are allegations of people charging anywhere between Rs 100 to 500 to process the applications of these women. Also, government officers are so busy processing these schemes, that they don’t have time for other work.

The current debt situation

There is a major difference between freebies and welfare schemes. The idea behind freebies is only to entice voters, which later becomes a huge burden on states. After doling out various freebies, the Madhya Pradesh government has been borrowing heavily to honour its debt repayments.

Overall, the debt of India is piling up. India’s current debt-to-GDP ratio is 58.2%. Maharashtra and MP are not alone but Punjab, Telangana, Andhra Pradesh and many other states are heavily influenced by the freebies and their debt has grown high.

I have compiled the following chart of debt of the states in 2020 and 2023 from RBI’s State of Finance Report:

To manage the finances the government will certainly levy more charges on petrol, oil and other items to generate additional income to fund the freebies. Additionally, the state governments will also introduce different charges to service the debt.

Pressure on banks

The pressure is also high on the banks. I recently visited a leading PSU bank which was full of people, mostly women crowding there to open accounts or process their applications for the Ladki Bahin scheme.

In fact, the United Forum of Banks Unions has called a protest on November 16, given the pressure the bankers are facing.

The social angle

Amid this, there is also a social angle to it. While there has been a consistent 6-7% growth in India over the last few years, it has not percolated to the bottom of the pyramid much. While the rich and the middle class have seen their profits and salaries rise, wages for the poor have stagnated for the last many years as the number of job seekers has grown but employment generation has not kept pace. On the other hand, inflation has leapt, so some help from the government – be it payment to women, help to farmers or medical insurance for the elderly— surely brings some relief to those fighting on several fronts. This has also helped the middle class in some way as wages would have to rise for the poor if there is no government help for them. Just think, how would your maid, security guard and other informal workers sustain only on pay that has not been raised for years.

But also, there are several people who do not pay taxes such as rich farmers and businessmen who evade taxes. Sadly, it’s the middle-class person who has to pay a lion’s share of taxes but doesn’t get much quality of life in return.

Let us not forget what former UK Prime Minister Margaret Thatcher once said, “There is no such thing as public money, there is only taxpayers’ money.”

(Editor’s note is a column written by Amol Dethe, Editor, ET CFO. Click here to read more of his articles exploring several buzzing topics)