[ad_1]

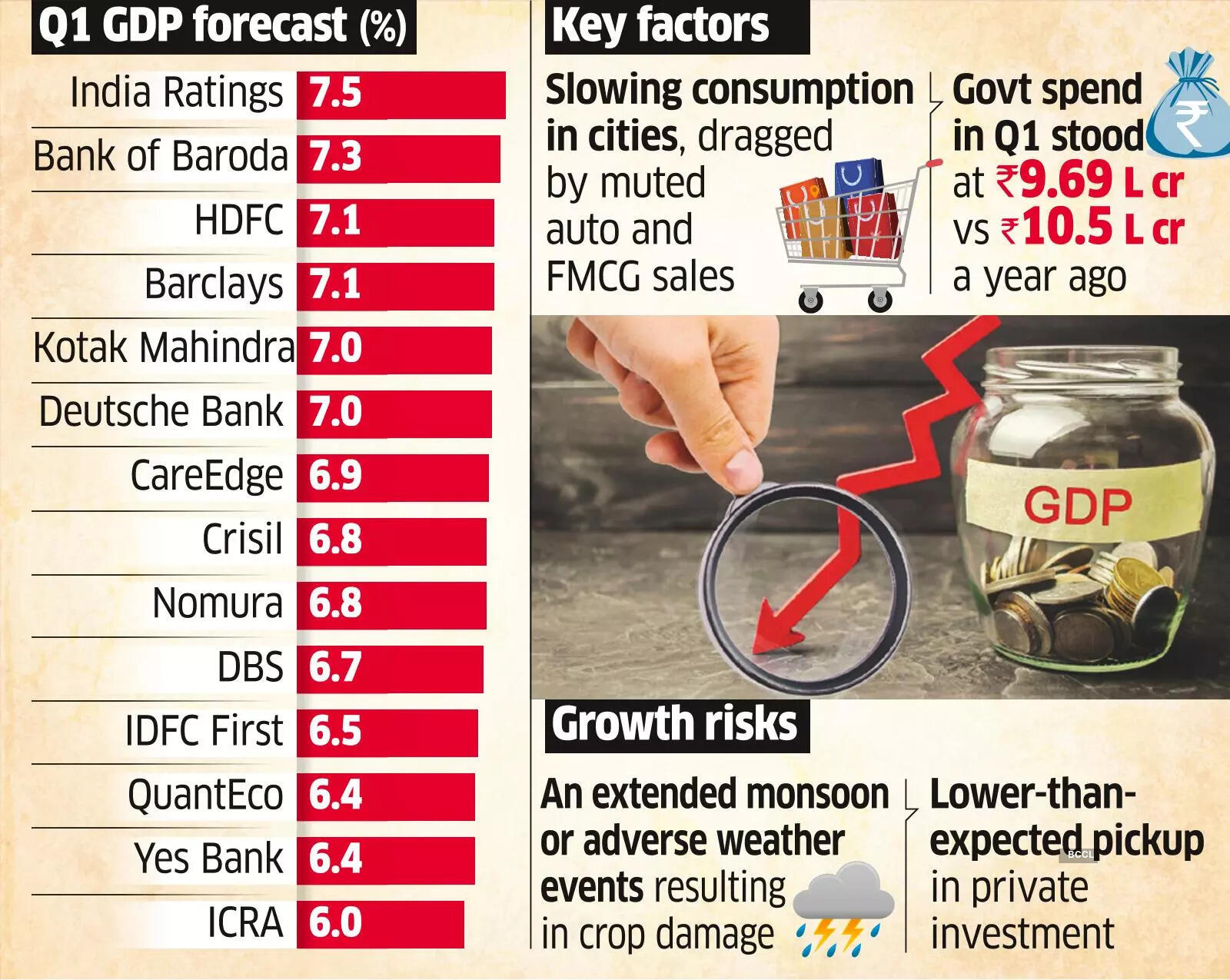

Slowing urban consumption, softer manufacturing sector growth and moderate government expenditure amid elections may have dragged down growth in the first quarter of FY25. India’s economy likely grew by a median 6.85% in the April-June period from a year earlier, according to an ET poll of 14 economists, slipping from 7.8% in the last quarter of FY24 and 8.2% in the year before.

The growth estimates ranged from 6% to 7.5%. The median figure is lower than the RBI forecast of 7.1% for the quarter. “Slowing of manufacturing activity and lower government expenditure during the election period likely contributed to the slowdown in output growth in the quarter,” said Shreya Sodhani, regional economist, Barclays, pencilling in 7.1% gross domestic product (GDP) growth in the June quarter. The government will release June quarter growth data on August 30.

The general elections held in the April-June period impacted government spending.

Rural demand improving

Rating agency ICRA expects GDP growth to moderate to a six-quarter low of 6% with agriculture, forestry and fishing recording a tepid 1% rise.

The high base effect of last year will have an impact on the figure, said Bank of Baroda chief economist Madan Sabnavis.

“We have seen that the government expenditure during the first quarter has been modest, probably on account of the elections,” he said. “The other factor is that manufacturing has not shown the kind of take-off which we had expected earlier.”

Total government expenditure in the first quarter was Rs 9.69 lakh crore, down from Rs 10.5 lakh crore in the year-earlier period.

“We expect growth to moderate to 6.7% on-year in the first quarter, building in election-related impact which saw consolidated government spending slow in the period along with an uneven start to the monsoon and tepid commodity related gains. After this soft start, we expect growth to gain ground for the rest of the year, taking the full year average to 7% in FY25,” said Radhika Rao, senior economist, DBS Bank.

Industrial production growth in the first quarter of FY25 was 5.2%, higher than 4.7% registered a year ago. However, the recent decline in the RBI’s consumer confidence data and slowing passenger vehicle sales raise concerns about consumption demand, experts said.

Passenger vehicle sales in India fell 2.5% year-on-year in July.

“Urban consumption is showing signs of moderation with a slowdown in passenger vehicle sales and FMCG sales growth,” said IDFC First Bank in a note.

Rural consumption, which was subdued last year, is showing signs of improvement with continued strong growth in two-wheeler sales and higher tractor sales

Services sector

“Services sector growth is expected to further accelerate led by financial, real estate, and professional services. Services export has held up well despite overall global slowdown,” said CareEdge chief economist Rajani Sinha.

An extended monsoon or adverse weather events resulting in crop damage, lower-than-expected pickup in private investment, or escalation of geopolitical risks are key risks to growth.

Rain in the June-September has so far been 3.5% above normal.

The International Monetary Fund expects India’s economy to grow 7% in FY25 while the RBI has pegged it slightly higher at 7.2%.

The central bank kept interest rates unchanged in its review earlier this month citing risks from volatile and elevated food prices.

[ad_2]

Source link