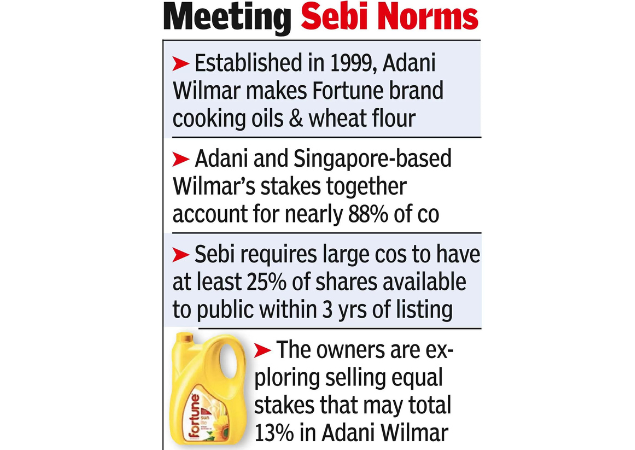

Billionaire Gautam Adani and Singapore-based food processing giant Wilmar International are in early talks with banks to sell a minority stake in their consumer joint venture Adani Wilmar, people familiar with the matter said, helping the company abide by shareholding regulations.

The owners are exploring selling equal stakes that may total 13 per cent in Adani Wilmar, said the people, asking not to be identified as the information is confidential. A sale that size would be valued at roughly $670 million as of Tuesday, and could take place as early as the coming months, the people said. Shares of Adani Wilmar have slid 7 per cent this year, valuing the company at about $5 billion.

The partners may opt to sell their stakes in one or multiple tranches, depending on investor appetite, the people said. Adani and Wilmar have until Feb next year to pare their combined holding to 75 per cent, in line with Sebi requirements. Considerations are ongoing, and details such as the size of the stake sale and timing could still change, the people said. Representatives for Adani Group and Wilmar International declined to comment, while Adani Wilmar didn’t have any immediate comment.

Adani and Wilmar’s stakes together account for nearly 88 per cent of the company’s shares. Sebi requires that large firms must have at least 25 per cent of shares available to the public within three years of the date of the listing.