[ad_1]

It’s no secret that climate change is a tremendous threat to the future of the planet. The world needs to reach net-zero emissions by 2050 to meet the global temperature reductions outlined in the Paris Agreement. Corporates are increasingly making progress in this area and about 35% of the world’s largest companies have pledged to reach net zero between 2030 and 2050, and many more stating a clear desire to decrease their carbon footprint.

Many Corporates find they cannot fully eliminate their emissions, or even lessen them as quickly as they might like. The challenge is especially tough for organizations that aim to achieve net-zero emissions, which means removing as much greenhouse gas from the air as they put into it. For many, it will be necessary to use carbon credits to offset emissions they can’t get rid of by other means.

Voluntary carbon markets can enable companies to engage in emissions offsetting, as a compliment to reducing their own emissions and where genuine emission reductions may not be technologically or financially viable. Voluntary carbon credits direct private financing to climate-action projects that would not otherwise get off the ground. These projects can have additional benefits such as biodiversity protection, pollution prevention, public-health improvements, and job creation. Carbon credits also support investment into the innovation required to lower the cost of emerging climate technologies.The Taskforce on Scaling Voluntary Carbon Markets (TSVCM), sponsored by the Institute of International Finance (IIF) with knowledge support from McKinsey, estimates that demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050. Overall, the market for carbon credits could be worth upward of $50 billion in 2030.

Challenges to Carbon Credits adoption

Given the demand for carbon credits that could ensue from global efforts to reduce greenhouse-gas emissions, it’s apparent that the world will need a carbon credit that is large in volume, transparent and traceable, verifiable and impactful, and environmentally robust. Today’s market, though, is fragmented and complex. Some credits have turned out to represent emissions reductions that were questionable at best.

- Limited pricing data make it challenging for corporate buyers to know whether they are paying a fair price

- High-quality carbon credits are scarce because accounting and verification methodologies vary with technologies.

- Carbon credits co-benefits such as community economic development and biodiversity protection are seldom defined

- Data and transparency issues act as a headwind for progress within the ESG space, as there is a continuous need for data analytics to help companies make informed decisions about their investments

- suppliers also feel the risk to manage financing and working on carbon-reduction projects without knowing how much buyers will ultimately pay for carbon credits

- until recently there were no clear standards and certification for carbon credits at global level.

These challenges are formidable but not insurmountable. Verification methodologies could be strengthened, and verification processes streamlined. Complete transparency, use of IOT based data capture, use of blockchain would help give buyers and suppliers more confidence in their project plans and encourage investments in carbon credits generation. And all these requirements could be met through the careful development of an effective, large-scale voluntary carbon market.

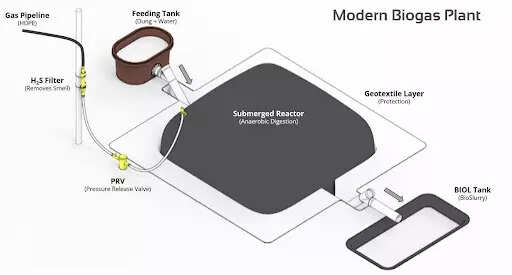

A variety of greenhouse gas reduction projects can create offsets and credits. These include forestry projects (avoidance of logging, sapling planting, etc.), renewable energy projects (wind farms, biomass energy, biogas digesters, hydroelectric dams, etc.), as well as energy efficiency projects.

Introduction of Modern Biogas Plants

In the last 5 years, India is witnessing a spurt in demand for a new kind of biogas plants which offers flexible prefabricated biodigesters, portability, extended warranties up to 10 years, and end-to-end after-sales commitment from the manufacturers to the farmers. This allows smallholder households with livestock to reduce their dependence on polluting firewood and expensive fossil fuels, generate their own biofertilizer and reduce their expenses on chemical fertilizer purchases. Daily cooking from these modern biogas plants is fast, effortless, smokeless, improving family health, especially among women and children.

These modern biogas plants address three of the most pressing challenges faced in developing countries like India:

- it supports key energy needs i.e., cooking and, thereby, the livelihoods of large populations.

- it helps in reaching the last mile, specifically in climate-vulnerable geographies with unreliable clean cooking options; and finally,

- it meets rising energy demands in a climate-responsible manner.

Carbon Programs with Modern Biogas Plants

The emissions saved from a certified biogas project can be claimed as carbon credits. Businesses can then purchase these credits and the project can be refinanced. One of the main challenges in the voluntary carbon markets was the lack of standardization, integrity, and transparency. New carbon projects with modern biogas plants are providing the much-needed data analytics that can help corporate buyers to make informed decisions about their investments. The use of artificial intelligence and machine learning is aiding the digital monitoring, reporting, and verification (DMRV) process.

More than 90% of corporate buyers identify DMRV as a critical factor influencing their credit purchase decisions. As the focus on carbon offsets intensifies, buyers are increasingly inclined to ensure that the credits they acquire are both demonstrably impactful and defensible to accusations of greenwashing.

The opportunity to invest in carbon projects with modern biogas plants has immense benefits to all stakeholders.

Given the magnitude of change that must happen for the world to get back to 1.5°C by 2100, all climate efforts are important right now. While local governments must take bold action, national and multinational corporations must also increase their interests in modern biogas plants.

To march towards their net zero goals, companies have been doing activities such as recycling, purchasing energy-efficient appliances, reducing air travel etc, all are helpful, but not enough. Corporations adding carbon credits to their net zero plans is a significant opportunity, and we are already starting to see seeds of momentum in the market.

[ad_2]

Source link